The Short Answer: Standard renters insurance typically does not cover flood damage from natural disasters or rising water. A separate flood insurance policy is needed for protection against flood-related losses to personal belongings.

Many renters discover too late that their renters insurance policy leaves them unprotected when flood waters rise. This guide examines what renter’s insurance actually covers, what it excludes, and how to properly protect your personal property from flood damage. We’ll explore the differences between water damage and flood damage, explain why insurance companies treat them differently, and outline the steps you can take to safeguard your personal possessions.

Understanding your insurance coverage is the first step in protecting your belongings from devastating flood losses. Whether you live in a high-risk flood zone or want to be prepared for unexpected disasters, knowing exactly what protection you have, and what you might need, helps you make informed decisions about your rental property insurance needs.

Understanding Flood Coverage Basics

What Counts as Flood Damage?

For insurance companies, flood damage occurs when water flows into your home from external natural sources like rivers, storms, or heavy rainfall. This differs from other types of water damage that might happen inside your home. When water enters from the ground up and affects multiple properties in your area, insurance providers classify it as flood damage.

Standard Renters Insurance Coverage

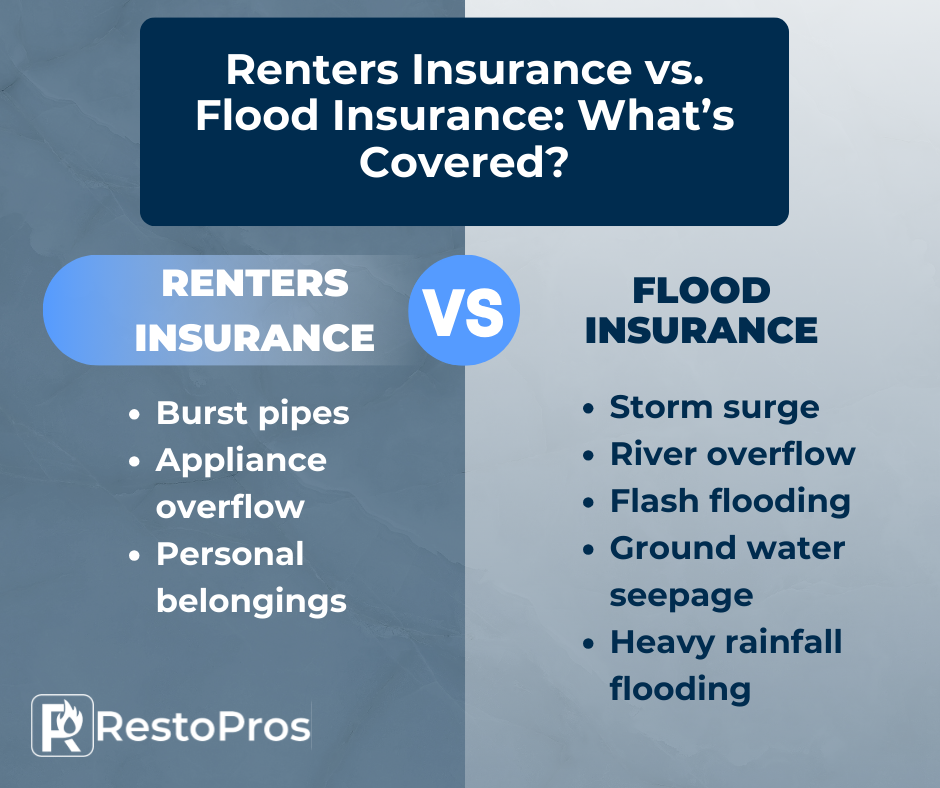

Standard renters insurance policies typically cover water damage from internal sources, such as burst pipes, overflowing appliances, or sudden plumbing failures. However, these renters insurance policies don’t include coverage for flood damage from natural disasters or rising water. Renters need to understand this distinction when protecting their personal belongings.

Types of Water Damage

Water damage falls into two main categories when it comes to rental property. The first includes sudden internal issues like burst pipes, accidental overflows, or water heater failures, these are usually covered by standard renter insurance. The second category involves external flooding from weather events or rising waters, which requires separate flood insurance coverage.

Some examples of covered perils under standard renters insurance include:

- Washing machine overflow

- Burst pipes during winter

- Leaking air conditioning units

- Accidental bathtub overflow

Non-covered flood scenarios typically include:

- Storm surge from hurricanes

- River overflow

- Flash flooding

- Ground water seepage

- Rising water from heavy rainfall

Most renters find out about these coverage limitations after water damage occurs. Professional water damage restoration companies work with both standard insurance and flood insurance claims, helping renters navigate the claims process regardless of the water source.

Flood Insurance for Renters

National Flood Insurance Program (NFIP)

The National Flood Insurance Program provides flood coverage options for renters through participating insurance companies. While a landlord’s insurance typically handles structural coverage, renters can purchase contents-only coverage to protect their personal belongings. These flood insurance policies cover damage directly caused by flooding, which occurs when water enters your home from outside sources like overflowing rivers or heavy rainfall.

NFIP policies for renters focus on protecting personal property up to specific coverage limits. Coverage begins 30 days after purchase in most cases, making it important to plan ahead rather than waiting until flood damage is imminent.

Private Flood Insurance Options

Several insurance providers now offer flood coverage alternatives to the NFIP. These renter insurance policies often provide more flexibility in coverage options and may offer shorter waiting periods before coverage takes effect. Insurance companies typically process claims faster and may provide higher coverage limits for personal property.

When comparing flood insurance policy costs, factors like your high-risk flood zone location, the amount of coverage needed, and your chosen deductible affect monthly premiums. Some private policies include additional coverage not available through NFIP policies.

Coverage Components

Personal property protection through renters insurance policies covers items like furniture, electronics, clothing, and other personal items damaged by flood waters. Most policies require an itemized list of damaged belongings during claims, so maintaining a current home inventory with photos and receipts proves valuable.

Many private flood insurance policies include coverage for additional living expenses if flooding makes your rental property uninhabitable. This coverage helps pay for hotel stays, short-term rentals, and other costs while your home undergoes repairs. However, NFIP policies typically don’t include this benefit, making it worth considering when choosing between government and private insurance coverage options.

Standard renters’ insurance policies alone won’t cover flood damage, making dedicated flood insurance an important consideration for renters in flood-prone areas. Working with an insurance agent helps identify the most suitable coverage for your situation.

What to Do After Flood Damage and Water Damage

Call RestoPros: Professional Restoration Services

Professional water damage restoration should begin within 24 hours to prevent secondary issues like mold growth. When you call a restoration service, they will:

- Perform a thorough assessment of the damage

- Use professional equipment to extract standing water

- Set up industrial drying equipment

- Monitor moisture levels throughout the process

- Clean and sanitize affected areas

- Document everything for insurance coverage purposes

- Assist in Handling Insurance Claims

The restoration team will handle all aspects of the cleanup, from water removal to final repairs. They work systematically to return your property to its pre-flood condition, communicating with you throughout the process about progress and next steps.

Immediate Steps for Safety: Turn Off Electricity

When flood damage occurs, your first priority is safety. Turn off all electricity to affected areas if you can safely reach the electrical panel. Avoid walking through standing water, as it may contain harmful contaminants or hide dangerous objects. Move to a safe, dry location and wait for professional help to arrive.

Take photos of the property damage and personal belongings as soon as it’s safe to do so. Document everything affected by the flood, including walls, floors, furniture, and personal items. This visual evidence will be valuable for your insurance claim.

Working With Insurance: Document Damage

Contact your insurance company right away to report the flood damage. Most insurance policies require prompt notification to process claims effectively. Your insurance provider will guide you through their specific requirements and documentation needs.

Keep all receipts related to additional living expenses or emergency repairs. The insurance company will need a detailed inventory of damaged items, including their approximate value and age. Professional restoration companies like RestoPros work directly with insurance providers, helping to document damage and provide necessary evidence for claims.

Get Covered Before It’s Too Late

Standard renters insurance policies do not cover flood damage from natural disasters or rising waters. To properly protect your personal belongings from flood events, you’ll need to purchase a separate policy through the National Flood Insurance Program (NFIP) or a private insurance company.

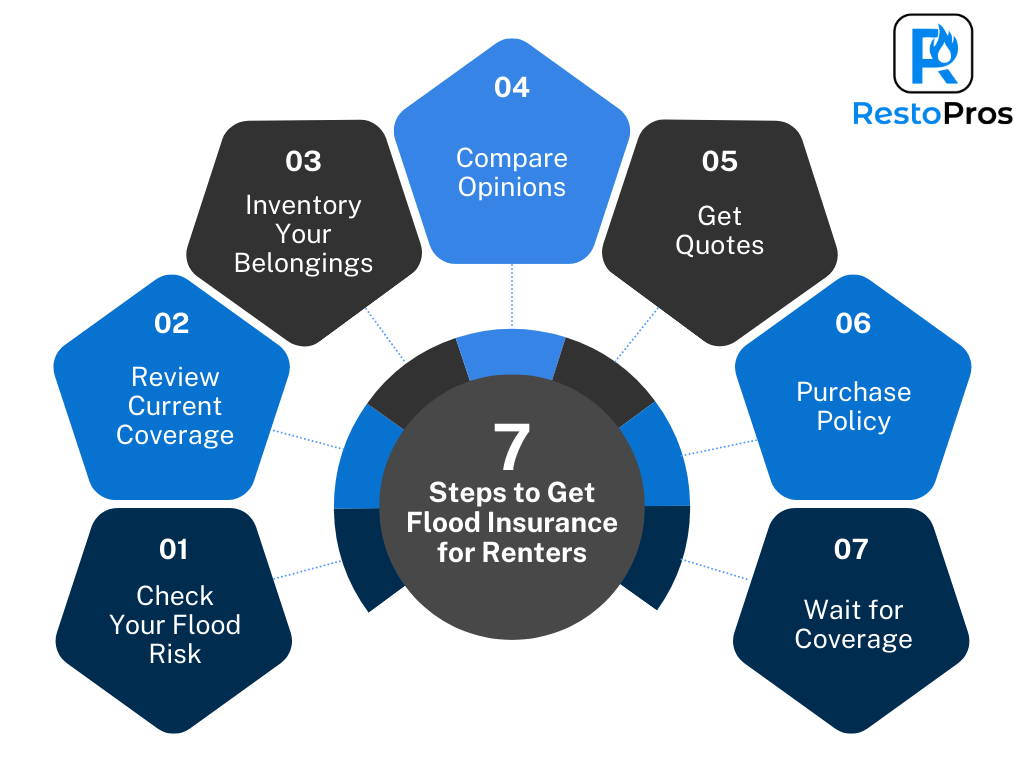

Essential steps for flood protection:

- Review your current renters policy with an insurance agent

- Understand exactly what water-related damage has insurance coverage

- Consider additional living expenses coverage for temporary housing

- Evaluate if you live in a high-risk flood zone requiring special protection

Take time to review your current renter insurance policy and understand exactly what water-related damage is covered. Contact your insurance provider to discuss adding flood coverage if you live in a high-risk flood zone. While you can’t control when flooding occurs, you can prepare by having the right insurance protection in place.

If you experience water damage from flooding or other sources, don’t wait to take action. RestoPros provides 24/7 emergency water damage restoration services, with trained professionals ready to respond quickly. Our team has the experience and equipment to properly extract water, dry affected areas, and restore your property. Contact RestoPros today at 803-850-6100 to get immediate assistance with any water damage emergency.